Nowadays you can get loans to meet your financial needs. Everyone can take the help of loans

to get their work done. If you want to take a loan, what should you do? Can you qualify for a

loan if your CIBIL score is low? This article provides information on how you can secure a

personal loan if your CIBIL score is low. It also mentions the precautionary measures to be

taken for it.

What is a CIBIL score, and why is it important?

If your CIBIL score is a three digit number. So it shows loan credit worthiness ranging from 300

– 900. Higher score with higher number indicates better credit worthiness. If you want to take a

loan, banks and financial institutions will check your CIBIL score before approving the loan. If

the CIBIL score is more than 750, you can get a loan at a low interest rate. But if your CIBIL

score is low, you will also find it difficult to get a credit card.

Loan Options for Those with a Low CIBIL Score

If your CIBIL score is low then you don’t need to worry. Check out the options for that given

below.:

1.Non-Banking Financial Companies (NBFCs):

> It is more flexible for people who have lower ClBIL score.

> In order to get a loan, income proof and KYC documents have to be submitted.

> Remember that the interest rates of NBFCs are higher than the interest rates offered by other

banks.

2.Online Loan Apps:

>There are many applications that come in your mobile offering loans.

> The online process is simple, just download the application and register with your mobile

number and upload your KYC documents and your selfie photo.

> After this information is approved, add the bank details and the loan amount will be available.

>But the interest rates of the loans available through this application are very high so be careful.

3.Peer-to-Peer (P2P) Lending Platforms:

>Through this application, they connect online loan borrowers directly with individual investors.

>They give more importance to other factors and rely less on CIBIL score.

>The interest rates of these loans vary depending on your risk profile.

4.Secured Loan Options:

>If you own any property or valuable asset, you can secure your loan by offering it as a call

letter.

> For example, gold loan and property loan. >These loans become more convenient and useful

for individuals with low CIBIL scores.

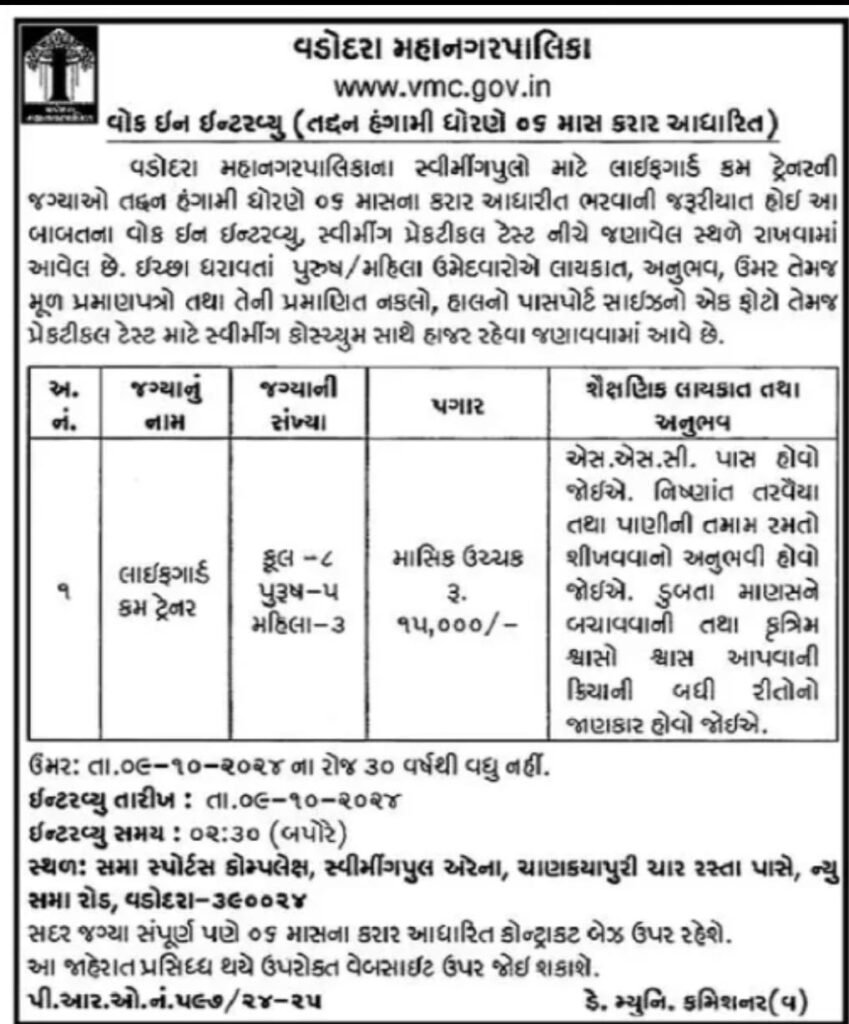

Vmc 10 pass bharti 2024

High court update

| Eligible list belif | Click here |

| HC DYSO, Eligible list | Click here |

Required Documents:

If you have a low CIBIL score and want to take a loan, the following documents are required.

- KYC Documents:

- Aadhar Card,

- PAN Card,

- Voter ID Card,

- Passport (if available),

- Any valid Photo ID Proof.

Proof of Address:

Electricity or Water Bill,

Aadhar Card,

Passport,

Bank Statement (last 3-6 months).

If your CIBIL score is low, the requirements of income proof (may not be required for some

NBFCs or loan apps) documents and other documents may change while taking a loan.

Remember and watch the following points for that.

Higher Interest Rates:

>Individuals with lower CIBIL scores will have higher interest rates.

>Make sure you can EMI easily.

Additional Charges:

>Before taking a loan, know about its processing fee, late payment and prepayment penalty.

Smaller Loan Amount:

>If your CIBIL score is low, you may be allowed to get a lower loan amount than you expected.

Shorter Loan Tenure:

>If the tenure of the loan taken by you is short then the monthly EMI amount will be higher.

Beware of Illegal Lenders:

>Get loans only from institutions approved by RBI.

>Before taking the loan, if the conditions given in it are very easy or offer high interest rate, be

less cautious.

Privacy Concerns:

>There are also some apps that request data on your phone.

> Trust a valid app and only accept information from that app.

Tips to Improve Your CIBIL Score:

>Pay the EMI time to time.

> Regularly pay off the credit card bill in full every month.

>If using a credit card, keep it below 30%.

> Do not apply for unimportant loans.

>Check your credit card regularly and correct errors.

If your CIBIL score is low then you can get loan through NBFC, loan application, p2p platform.

But it is important to understand the additional interest rates and other fee conditions and

difficulties mentioned in it. It is important to understand that loan must be taken through RBI

approved application and from institutions only.

If you are getting a small loan, the first priority is to improve your CIBIL score. Paying credit card

bills time to time, managing credit cards and paying EMIs will strengthen your financial position

and hence provide better loan options in the future. .

Jayesh